A headline is supposed to break some news, but sadly, the title on a recent price survey by vehicle data shop iSeeCars is probably familiar to anyone who's been car shopping: “Used Cars Priced Under $20K Are Vanishing.”

iSeeCars analyzed 10.8 million used-car transactions to arrive at these numbers. Ready to be bummed out? Here goes:

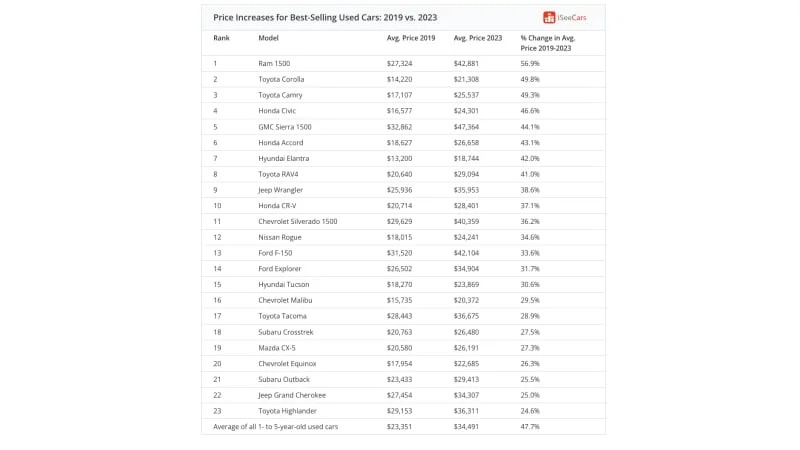

Quantum leap: The average used car’s price has increased a gobsmacking 47.7% since the pandemic. A 1- to 5-year-old used car cost on average $22,493 in 2015. By 2019, that average had grown only by about a grand, to $23,351. You can view that as a baseline to compare what happened next: In the next four-year interval, the price shot up to to $34,491 in 2023.

A lot happened in those four years to explain this, a cascading series of factors involving simple supply and demand: Pent-up demand as we emerged from lockdown, paired with scarcity of new cars because of supply chain problems and chip shortages, drove the average price of new vehicles up 30%, if you could find one at all. So, people needing transportation turned to used cars and drove those prices up even more. And both new and used cars became major drivers of post-pandemic inflation in general. More on that in a moment.

Dwindling affordable choices: Just four years ago, in 2019, half of the used cars on the market, 49.3%, were priced at under $20,000. Now that price point is just 12.4% of the market.

Higher miles: More than half of 1- to 5-year-old cars on the market today across all price points have an average of 20% higher miles on them than they did four years ago. Looking at sub-$20K cars in particular, back then they had an average of 43,541 miles. Now that average is 63,457, an increase of 45.7 percent.

People may have traveled more for recreational reasons during and after the pandemic, but the higher miles are a little strange given there’s been less commuting. People probably hung on to their cars longer.

A vivid example: iSeeCars offers a great example about what has happened to two popular models in particular, the Honda CR-V and the Toyota RAV4. Four years ago, half of those two popular models on the market were priced at under $20,000. Now, just 2% of them are below that threshold, and you can probably imagine the high miles on those particular examples. At the bottom of this post, we’ve attached a chart of what has happened to other popular models.

“Among the pandemic’s many casualties is the affordable used car, which has nearly vanished from the used car marketplace,” said iSeeCars’ Executive Analyst Karl Brauer. It gets worse for those who have even less to spend. “In 2019, used car shoppers with a budget of $15,000 could afford over 20% of the late-model used car market. Today that budget only gets them access to 1.6% of the market.”

Keep in mind that when the dollar is adjusted for inflation, $20,000 in July 2019 is the equivalent of nearly $24,000 today. That’s a 19% increase that you can regard as baseline inflation. In other words, $20 grand doesn’t mean the same thing as it did four years ago, so that’s one reason the number of $20K cars is fewer. But if you apply some Kentucky windage to iSeeCars’ data, it shows that cars costing under $25K today make up 19.5% of the market — still way less than the 49.3% under $20K four years ago. The iSeeCars report contains a chart that shows a seismic shift in market share among the price categories, with cars in categories above $35K seeing increases in market share amounting to hundreds of percent change.

If you’ve eaten in a restaurant lately, you know what inflation’s done to a sandwich or a steak. The price of a Big Mac, which is often used as an inflation yardstick, has risen from $3.79 in the past four years to $5.19 today — a 36.9% increase. As inflated as that sounds, it’s still less than the 47.7% increase in used cars, and just another yardstick that demonstrates what’s happened to cars is particularly vexing.

One other factor in all this that's not mentioned in the iSeeCars report: There are nearly no $20,000 new cars anymore, as we detailed a few months back. (Though we’ve suggested some good used alternatives.) Automakers have largely abandoned the lower price points by doing away with affordable models like the Ford Focus or Chevy Cruze. And demand is so high for a relatively affordable model like the Ford Maverick that dealers are marking them up and making them unaffordable. This affordability gap in the new market is going to be reflected in the used market as these cars come up for resale.

Above all — above all this — median income according to one measure from the Bureau of Labor Statistics is up by about 20% in the same period. Which doesn’t sound so bad, and jibes with the constant-dollar calculation. (But another calculation shows household income has, in real terms, actually decreased.) Buying power is clearly not keeping up in many areas, cars being one of the worst.

So what can a car buyer do?

We don't have to just take this on the chin.

First, what not to do: Don’t compensate for all this by taking out a big loan spanning many years. Unfortunately, a lot of people are doing just that. With loans of six or seven years, it’s a sure way to get underwater on a car’s value. As crazy as the car market has been, vehicles still don’t exactly appreciate. And considering that interest rates are up, you could pay hundreds or even thousands more than the already-inflated price. Don’t be that guy. Car dealers and bankers love that guy.

Instead: Wait. We may have turned the corner. Last month's Consumer Price Index data showed that new cars edged down by 0.1% in July, with used prices down 1.3% for the month, and dropping 5.6% year over year. New cars are becoming more available, taking pressure off the used market, and the Federal Reserve’s moves to tame inflation might actually be turning the ship around. Car prices need to come down a lot more, but may be headed in the right direction. Of course, you’ve probably been waiting a long time already.

Love the one you’re with: The consequence of waiting. If used cars are lasting longer, then your used car can probably last longer. The average car on the road today is 12.5 years old. Change the oil, park it under a shade tree and give it a good detailing, and you might rekindle your love, or at least tolerance, for what you’ve got. Even when cars were more reasonably priced, the adage of cheaper to keep ‘er applied.

Stick it to the man: Also, abstaining from a purchase … at least for a while … is how you can do your small part to turn the tide. Supply and demand cut both ways. Another good sign is that rebates, which had become virtually nonexistent, are starting to make a comeback.

Even if paying more, at least you’re getting more for your money: Cars get more feature-laden with each passing year. The newer the used car, the better equipped, safer, and more fuel efficient. Even at higher prices, you can take some solace in that.

Also reset your expectations on mileage: One reason used cars now seem to have more miles is, they’re capable of more. To rack up 100,000 miles — any car can do that with ease. If you formerly sought out used cars with, say, fewer than 20,000 miles, you might find that you’re happy with a 50,000-mile car.

Zig where others zag: If you can’t find a reasonably priced top-rated model like those CR-Vs and RAV4s cited above, look for something else. Great is the enemy of good, and there are few truly bad vehicles anymore. Something less popular — something not on the list below — that's less in demand and carrying a softer price might serve you well.

Go to the iSeeCars full report for their deep dive into all this, including lots more charts.

Sign in to post

Please sign in to leave a comment.

Continue